|

TRANSLATE THIS ARTICLE

Integral World: Exploring Theories of Everything

An independent forum for a critical discussion of the integral philosophy of Ken Wilber

Joe Corbett has been living in Shanghai and Beijing since 2001. He has taught at American and Chinese universities using the AQAL model as an analytical tool in Western Literature, Sociology and Anthropology, Environmental Science, and Communications. He has a BA in Philosophy and Religion as well as an MA in Interdisciplinary Social Science, and did his PhD work on modern and postmodern discourses of self-development, all at public universities in San Francisco and Los Angeles, California. He can be reached at [email protected]. Joe Corbett has been living in Shanghai and Beijing since 2001. He has taught at American and Chinese universities using the AQAL model as an analytical tool in Western Literature, Sociology and Anthropology, Environmental Science, and Communications. He has a BA in Philosophy and Religion as well as an MA in Interdisciplinary Social Science, and did his PhD work on modern and postmodern discourses of self-development, all at public universities in San Francisco and Los Angeles, California. He can be reached at [email protected].

SEE MORE ESSAYS WRITTEN BY JOE CORBETT

The National Debt Delusion and MMT for the PeopleJoe Corbett

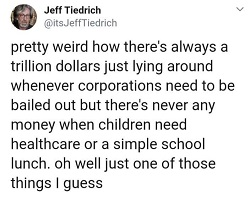

Clearly the problem isn't in pumping too much money into the system, but not pumping enough into where it is needed.

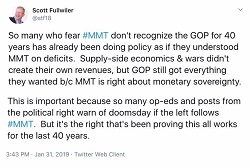

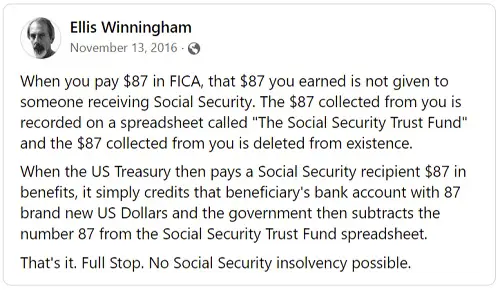

It is not uncommon to see media pundits going hysterical over the 32 trillion dollar national debt by saying this will bankrupt America, and that we are morally irresponsible to leave the burden of paying it down on future generations. In reality, for America and other advanced economies with their own currency, and who don't have a lot of debt in other currencies than their own, like Australia, Canada, England, Japan, China and many others, there is no national debt crisis no matter how much the deficit is. The fact about how money works is that a government that issues its own currency can never be in debt it cannot pay in its own currency. And when you really think about it, since the debt is owed to no one but the government itself in its own currency that it issued for social spending, the national debt does not in fact exist as a debt that needs to be paid back to anyone. Does the government need to pay itself back the money that it created to spend? Absurd!! The entire “national debt will ruin us” frenzy is nothing but a delusion. But what about the need for raising tax revenues and issuing treasuries to borrow from foreigners and the wealthy in order to have enough money to spend on needed social programs like the military, retirement, health care, and infrastructure? Again, this is a misunderstanding of how a sovereign currency actually works, and it's one of the biggest and most persistent delusions of our era. Does the government need to borrow its own currency, the money that it creates itself, from foreigners like China, or even from tax payers in order to spend on social programs, as if it could run out or “not have enough” of the money that it can and does create all the time? Absurd!! The fact of the matter is that taxes are simply wealth destruction, including the taxes that are taken out for the national “retirement fund”. After being received and recorded your taxes are deleted from your bank account, never to be seen again. There is no bank account at the Federal Reserve or the Treasury Department that says “Tax Revenues”. It simply doesn't exist because all those tax dollars no longer exist. They were already deleted from the bank accounts of tax payers, and they only exist on the accounting ledger of the state to keep track of who is being naughty or nice. Then when the government needs to spend on anything they simply reissue the needed currency and credit the appropriate accounts. End of story. Neither taxes nor borrowing is needed for government spending, and they never are used for that. As for treasuries, the source of government “borrowing”, they are simply a courtesy the government gives to wealthy investors who want a safe haven for their idle wealth and to foreign trading partners like China and Japan with lots of dollars they don't know what to do with to give them an incentive to keep taking our dollars in trade instead of having to pay them in their own currency for the goods they produce. One other purpose treasuries serve is taking out the potential amount of currency in circulation as a temporary safeguard against inflation any time the government wants to spend on a project. But in no case are treasuries ever issued to “raise money” for government spending. Absurd!! The understanding of how a sovereign currency actually works that I have been giving you here is called modern monetary theory, or MMT, and its main advocates are Stephanie Kelton, Randall Wray, Bill Mitchell, and Warren Mosler. It applies mostly to the post-gold standard economy, but the term “theory” is a little misleading because there is nothing theoretical about this. It's how the economy actually works, and it's even the view that both Alan Greenspan and Ben Bernacke had when they testified before Congress, with Greenspan saying, “There's nothing to prevent the federal government from creating as much money as it wants and paying it to someone”. My view is that the “someone” the government should be paying (or serving as a client) is all of us a little at a time rather than big banks and corporations time and time again to prop-up the financial system so they can continue to serve mostly their wealthy clients and make people like Greenspan very happy. Indeed there is a class warfare component to how MMT is currently applied. It's been called trickle down economics or neoliberalism since Ronald Reagan and Margaret Thatcher busted worker unions and went full corporate support to enrich the upper-classes and wall street investors. QE or quantitative easing, when the Fed creates money out of thin air and gives it to the banks to lend at profit, has only been the most recent way in which central banks have handled the failure of private banks and corporations to maintain extravagant profits for the wealthy amidst austerity for the workers from whom wealth has traditionally been extracted, but from whom extraction is becoming increasingly unviable as a source of profit as the conditions of the workers become increasingly precarious. Hence the need for MMT to support the wealth of the rich instead of only workers and consumers. Thus, pumping trillions of dollars into the corporate-financial system over the past decade and a half as a supplement to the paltry profits from the exploitation of precarious workers and consumers has allowed the wealthy to remain wealthy, for housing prices to bubble once again, and for wall street to have record “profits” (if you can call stock buy-backs wealth creation). Meanwhile infrastructure crumbles and the health, housing, and employment needs of ordinary people go unmet. Clearly the problem isn't in pumping too much money into the system, but not pumping enough into where it is needed, and this has been the direct consequence of the class war the rich and powerful have been waging on workers for the past 4 or 5 decades. Flooding the top echelons of society with money and hoping it will trickle down to the rest (if it ever does, and it rarely does) has been the role of MMT for the wealthy. My view, and the view presented by the current advocates of MMT, is to take back the power of money creation and give it to the people, not to the wealthy and their bankers. By giving the power of the national purse back to the people, infrastructure can finally be rebuilt and projects like high-speed public transportation can be implemented, free health care for all and public higher education for those who want it can be provided, housing for the homeless, food for the hungry, guaranteed employment for those who want it, a Green New Deal, and perhaps even a UBI for those who agree to self-development classes and participation in the individual and collective betterment of society, all of these and many more things can make the lives of ordinary Americans better and more secure for their developmental and spiritual needs. But as long as MMT is used to enrich the wealthy for the benefit of their private profits, none of this can be realized. Trickle down economics, neoliberalism by any other name, has become a fetter to the further development of society, and only revolution or MMT for the people can create the necessary course correction going forward. Critics say that MMT would create inflation, or even hyperinflation, by putting too much money in circulation. MMT advocates answer by saying that inflation would not be a factor as long as there are the resources and productive capacity to absorb the extra spending, which means of course that there are limits to how much social spending can occur before it becomes counterproductive, creating more money than there are things to buy, resulting in inflation. But for a country like America and the other mostly self-sufficient economies mentioned previously, they have more than enough capacity to meet the increased demands in the areas that would be targeted for spending, like guaranteed employment and housing, for which there is always a surplus sitting idle and waiting to be used. Want medicare for all to work with maximum efficiency? Build more hospitals and provide free education to aspiring doctors to meet the extra demand, and the same goes for any other project to meet a social need, like homelessness or a Green New Deal—invest in it, don't just let things lay idle with unmet needs and untapped potentials. And that's not something the private sector can do with the pressure to make immediate profits. We need the power of the national purse to work for the people, to provide for their needs and make them more productive without private investors who need to be paid back next week with profit returns. One thing that should be clear is that the national debt is actually the private sector surplus, so don't worry about the national debt, worry about who is getting the surplus and who is left out of receiving its benefits. The false idea that taxes are necessary for social spending is one of the biggest ideological obstacles we face in implementing MMT for the people, for as long as people think that their taxes, in other words, their hard earned labor, pay for things like other peoples health care and housing, they won't support it or they'll have resentment toward the poor (and mother earth!) who need these things. Thus begins the cycle of intra-class warfare where the upper classes get the middle classes to hate the working classes as moochers and parasites, when in fact it's just the opposite with the financial classes existing as interest bearing and rent seeking parasites on the labor of the middle and working classes, not to mention the resources and health of mother earth. Austerity, cutting back on social spending because of a perceived need to reduce the national deficit or because the economy isn't generating enough tax revenues for social spending, is basically the way the corporate and financial elites put the screws to ordinary working people so they will work harder with fewer complaints and at lower wages to shore up the profits of the wealthy. Cutting state budgets has nothing to do with a shortage of tax revenues for social spending, since taxes are not used for social spending in any case, but it has everything to do with the psychological and physical intimidation of the working classes in a class war that, as Warren Buffet says, his class has been winning for decades now. If the social and spiritual development of the advanced economies and of the world as a whole is to progress rather than regress at this conjuncture in history, MMT for the people must find its way into the ideological morass we currently live under in the name of the betterment of financial elites, and shatter the veil of delusion that has descended upon humanity to hold it back from fulfilling its full potentials as an empathic, compassionate, rational (sane), and creative species.

|

||||||